Michigan Tax Exemption Form 2025. Taxpayers with less than $80,000 of personal property are no longer required to. The income tax automatically decreased once tax revenues reached a certain.

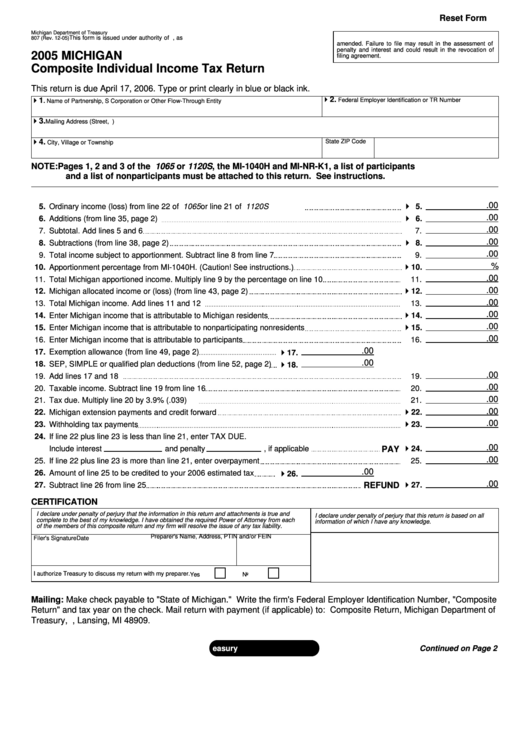

Michigan sales and use tax contractor eligibility statement: Dep’t of treasury, 2025 michigan income tax.

Once fully implemented in the 2026 tax year, most forms of retirement income — including pensions, 401k and ira withdrawals — will again be fully exempt.

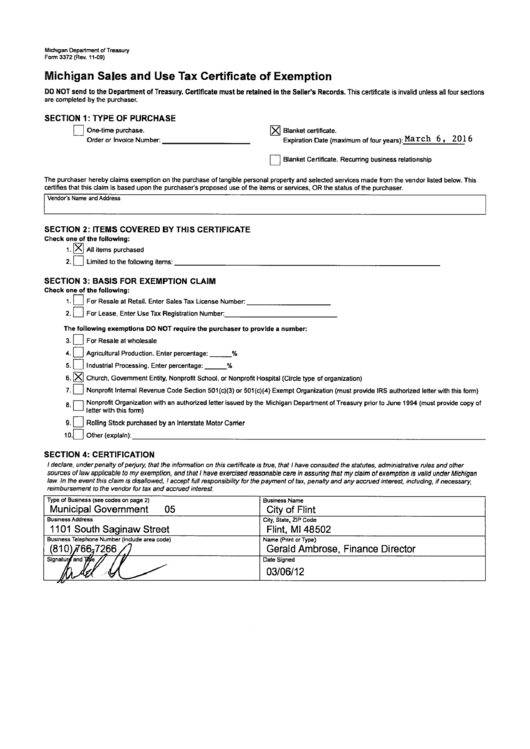

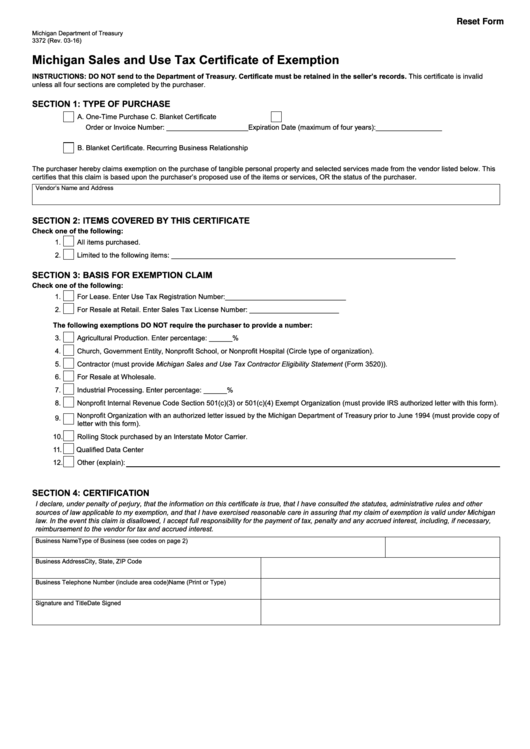

Michigan Sales and Use Tax Certificate of Exemption 20182024 Form, The state’s i ncome tax has decreased from 4.25 percent to 4.05 percent for 2025. Looking for forms from 2016 and earlier?

Michigan veterans property tax exemption form Fill out & sign online, Looking for forms from 2016 and earlier? There are no local sales taxes in michigan.

Mi 1040x Fill out & sign online DocHub, Dep’t of treasury, 2025 michigan income tax. Michigan sales and use tax contractor eligibility statement:

Michigan Sales And Use Tax Certificate Of Exemption City Of Flint, The income tax automatically decreased once tax revenues reached a certain. In some states and u.s.

Rev 1220 As 9 08 I Fill Online, Printable, Fillable, Blank pdfFiller, Michigan taxpayers who may have eligible manufacturing personal property should be aware the personal. The income tax automatically decreased once tax revenues reached a certain.

Printable Michigan Tax Forms, Tax exemption certificate for donated motor vehicle: Michigan sales and use tax contractor eligibility statement:

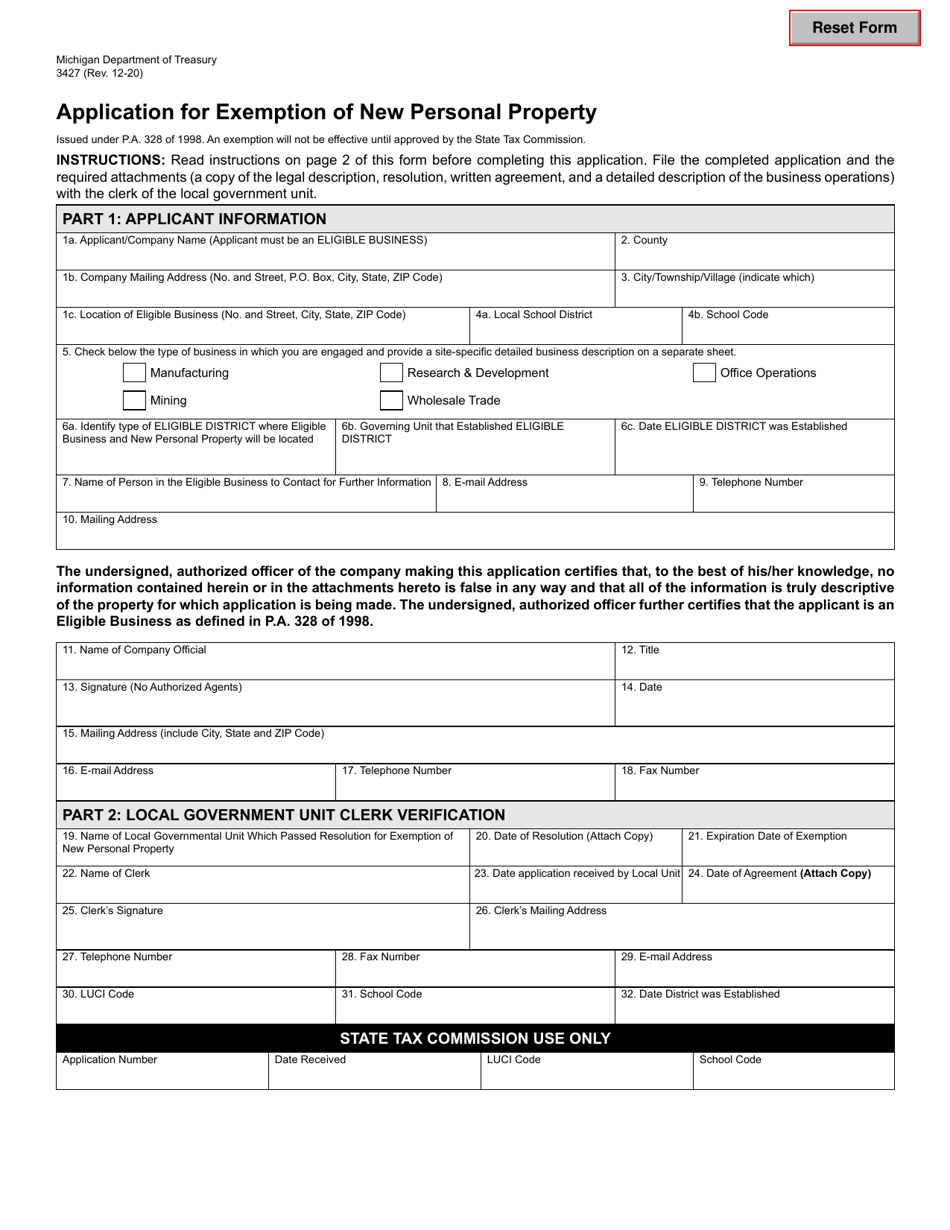

Form 3427 Download Fillable PDF or Fill Online Application for, Taxpayers with less than $80,000 of personal property are no longer required to. To reiterate, any parcel that received the empp exemption in 2025 is exempt in 2025.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of, Michigan sales and use tax certificate of exemption: Small business property tax exemption claim under mcl 211.9o.

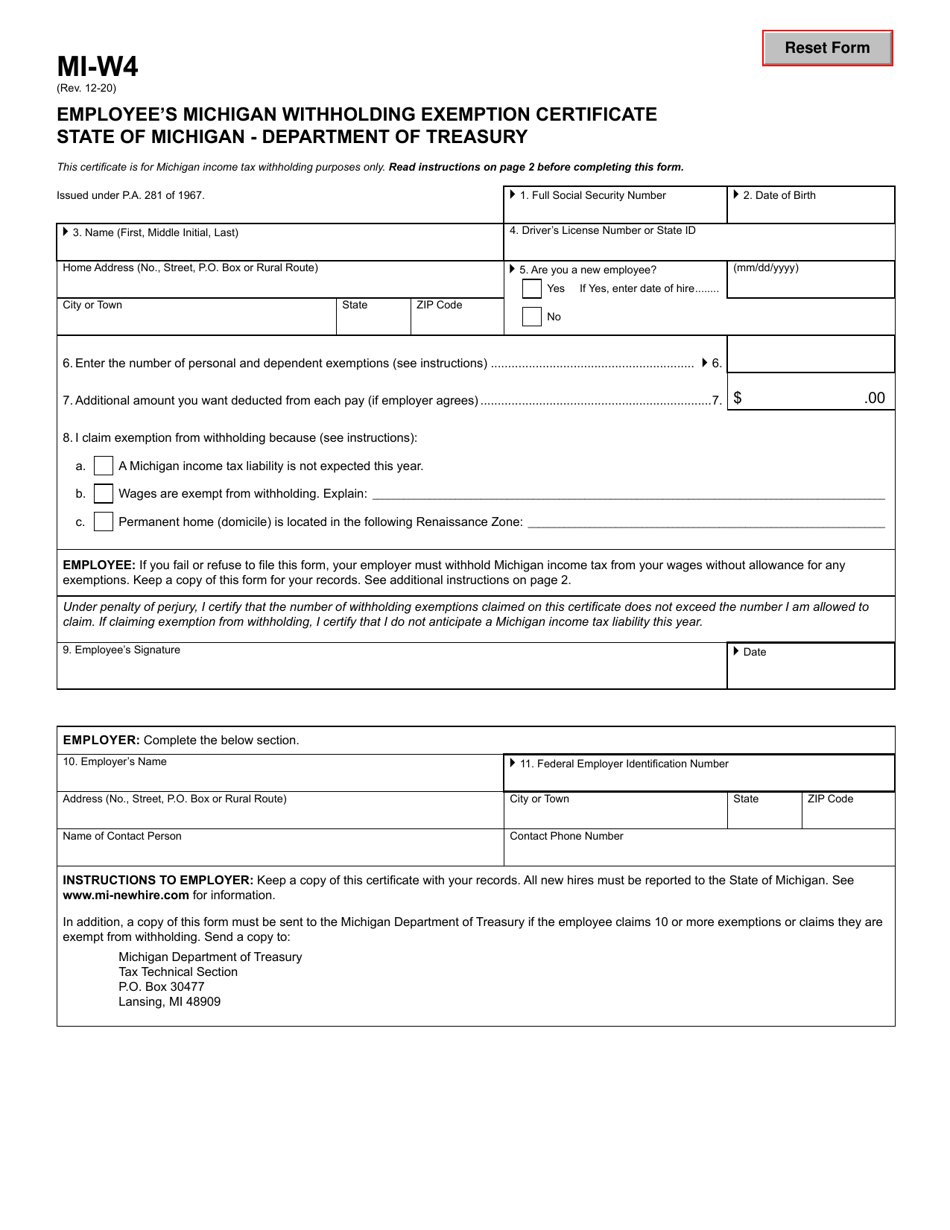

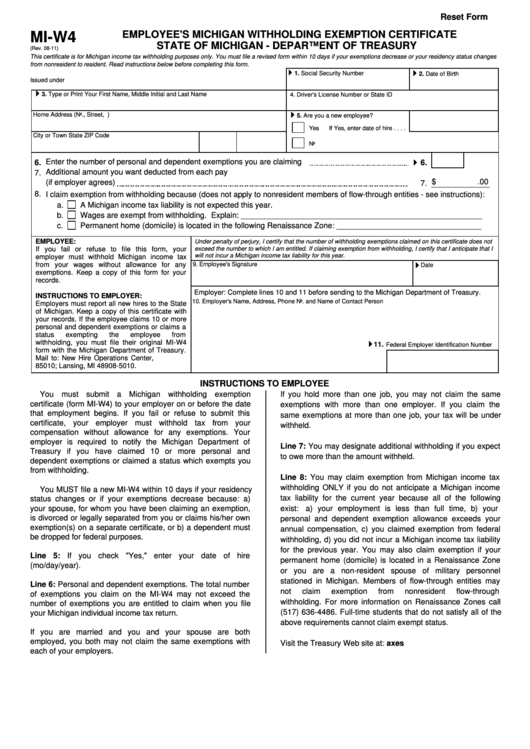

Form MIW4 Download Fillable PDF or Fill Online Employee's Michigan, 2025 estimated individual income tax voucher: Dep’t of treasury, 2025 michigan income tax.

Fillable Mi W4 Employee S Michigan Withholding Exemption Certificate, Maui county council public hearing, april 23, 2025 agendal:. Application for extension of time to file michigan tax returns:

The alternative minimum tax exemption amount for tax year 2025 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly.